Whitestein Technologies is proud to be a Platinum Sponsor to the annual...

You are here

LSPS Turns Digital Disruption into Opportunity for Community Banks

With unprecedented digital disruption in the banking industry, community and regional banks are facing new challenges—and new opportunities. Due to their size and relationship to their communities, they are traditionally more agile and have closer relationships with their clients than larger banks. But to continue to be more agile, community banks must evolve their back office systems into a more fluid, centrally coordinated tool. The resulting combined power of digital age technology and old school relationships with customers is fundamental to keeping community and regional banks a step ahead.

Community banks’ greatest digital challenge is that most depend upon older, standalone systems for CMS, loan origination, core banking, and document management. These siloed systems make processes slow and cumbersome, with staff needing to re-enter the same information as many as five times for a single type of application, such as a loan or credit application. Plus, most existing systems don’t support online services. Many can’t even capture email addresses or cell phone numbers.

The solution, however, does not need to be prohibitively expensive or complex. Community banks can layer Whitestein’s Living Systems Process Solution (LSPS) on top of these individual systems. This allows LSPS to integrate these systems and support process automation, enabling banks to:

- Save time previously wasted on re-entering information,

- Reduce errors that cause rework and delays,

- Speed end-to-end processes, for example, from application to loan close, and

- Spend more time building relationships with customers.

Commercial lending process: before and after LSPS

As an example, let’s look at the commercial lending process. In many community banks, when a customer calls to ask about a loan, an employee logs into a CMS and notes that the customer called, logs out, and then opens a spreadsheet to capture the loan information. Then the employee logs out of the spreadsheet and logs into the pricing system to choose the type of loan and set the appropriate interest rate. Then it’s time to upload supporting documents to the document management system. After that, the first employee passes the application to a processor who opens the loan origination system and rekeys information from the CMS into the loan origination system. Because many older loan origination systems demand that each open item be filled in order for the user to proceed, employees must enter placeholder information simply to start the loan process. Later, they go back and enter the real information, once it becomes available, in a complex, lumbersome, and iterative process.

In contrast, at a community bank with Whitestein’s LSPS, when an existing customer calls to ask about a loan, LSPS retrieves all the information on that customer from all the bank’s separate systems. It also loads data directly from credit bureaus or other sources. Agents can look at everything in one place and complete information as it becomes available. Place holders are automatically made for data that is not yet available. That information is, in turn, automatically distributed back to each of those individual systems. Employees can ask questions and get answers from each other —and that exchange becomes part of the record too, not tucked away in an email silo. When everything is complete, LSPS uploads the complete file to the loan origination system.

With LSPS, it takes less time to complete the loan process, benefiting both the bank and the customer.

Not just faster: Better And Different.

LSPS does more than just make processes faster and more accurate. LSPS is a goal-oriented system that integrates with existing systems and uses its cognitive capabilities to add intelligence into the system. This opens up a variety of new opportunities for community banks.

Reduce dependence on specialists: some loans—such as FHA or VA loans—need specialists to process them. With LSPS, other employees can at least get started capturing and calculating those loans, so that the process can begin even when the specialist is not immediately available.

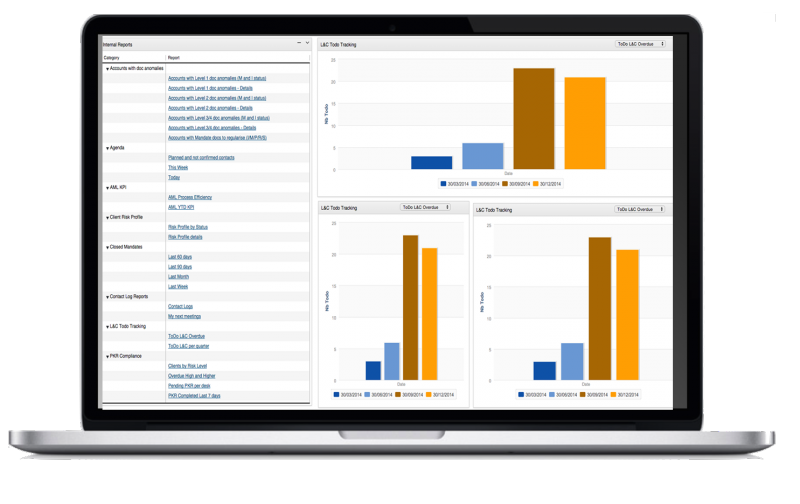

Make better business decisions: standard and custom data analytics reports help banks identify trends, risks, and opportunities. Banks can rapidly analyze loan portfolios, identify flawed processes, and figure out how to improve them.

Launch online services: LSPS can support a web portal by front-ending existing systems so customers can access services online. This way, banks can offer online services without having to make heavy investments in new systems.

Build a wealth management business: by freeing up employees from pushing paper and providing them easy insight into a customer's data, LSPS makes it easier for banks to identify and offer wealth management services to individuals. Big banks typically don’t offer this to customers with less than $3 million - $5 million, resulting in a large, unmet market need that could substantially contribute to a bank’s profitability.

For more information on how you can improve your community bank’s process performance with Whitestein’s LSPS, contact us for a demo.