Whitestein Technologies is proud to be a Platinum Sponsor to the annual...

You are here

Financial Services

Financial Services Case Management Framework

Banking and asset management companies all have certain business outcomes that must be achieved, both on the micro and macro level. LSPS Financial Services Case Management Framework provides the solutions that are specifically oriented to achieving these outcomes. Whether the solution encompasses the entire client lifecycle, or simply a single component of it, LSPS' unique software is model-driven, driving each process to achieve the specified business outcomes, all the while adapting to unexpected disruptions.

CRM Lifecycle Management

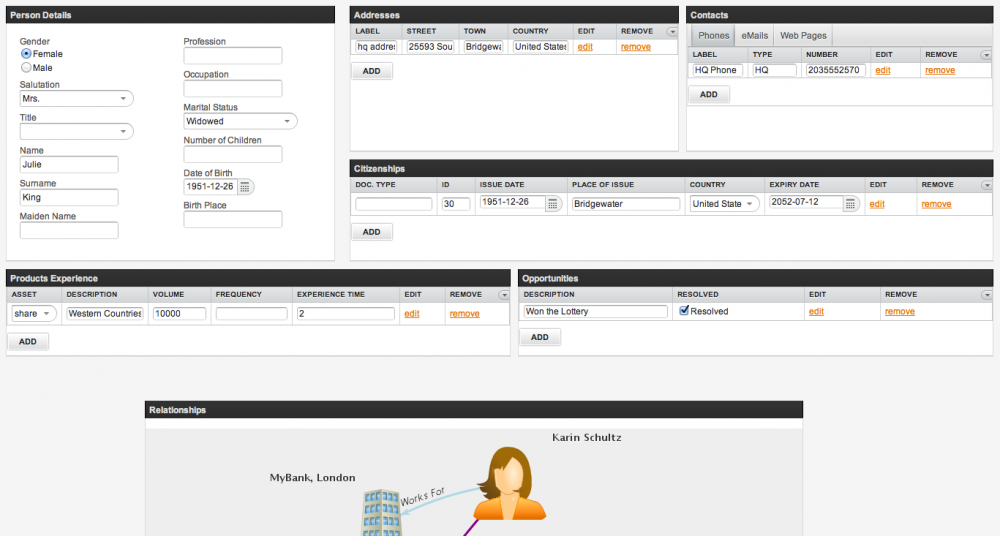

LSPS Client Lifecycle Management (CLM) is a standard framework for the end-to-end management of the client/customer lifecycle from a 360° perspective. From new client prospecting to account closure, the framework is configurable and customizable to the precise requirements of any financial organization. LSPS ensures that the processes and goals underlying the client lifecycle are intelligent, transparent, and agile, allowing financial institutions to provide unparalleled service with the utmost efficiency.

The Changing Customer

Contemporary customers of financial institutions demand far more than in the past. Customers expect to be at the center of how their cash, investments, and loans are managed and rarely have qualms about switching providers. Financial institutions must ensure that their customer's experience is both efficient and effective. LSPS CLM focuses on the clients' expected outcomes and adapts process and application behavior to ensure personal goals are met and maintained, while maintaining consistency with organisational policy and regulatory requirements, even as they change over time.

Client Prospecting

LSPS incorporates all components of Client Prospecting, including lead generation, identification, capture of basic information, and database checks. Initial contacts and meetings, legal and compliance checks, desk head confirmation, additional data entry, and travel approval requests are all processed and documented. Closing of this phase is also captured, from due diligence and account opening / client onboarding to reviewing existing prospects that are not converted into clients.

All information is readily accessible by client advisors, operations, and compliance, as required, in real-time. Data is intelligently directed along appropriate process paths, based on preset criteria or exception requests, with each component documented. LSPS ensures there is full transparency and auditability.

Client Onboarding and Account Opening

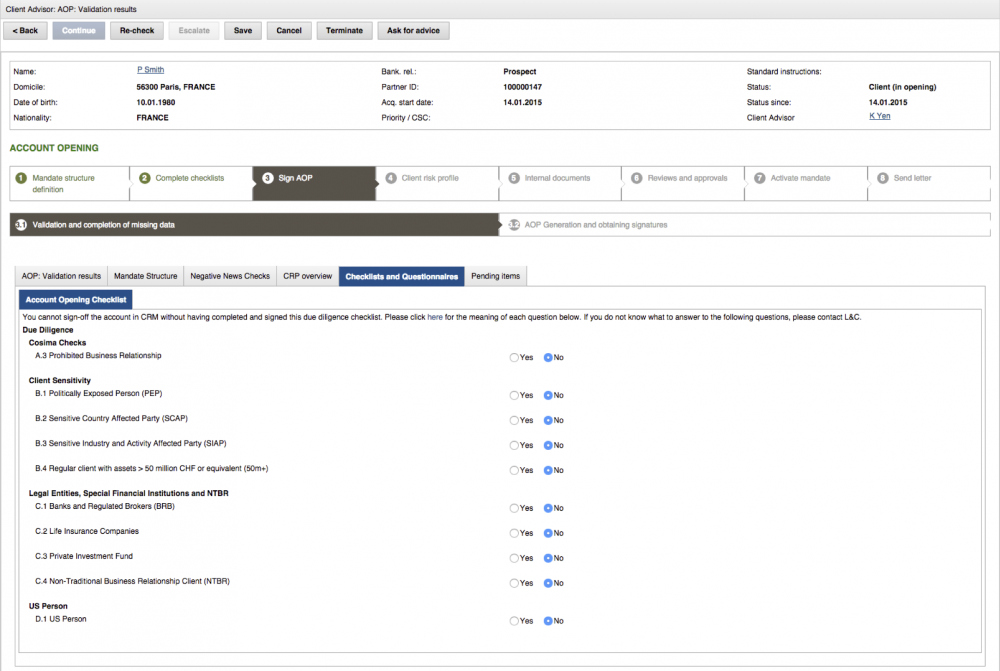

LSPS reduces the front and back office inefficiencies endemic to the account opening process, making client onboarding a more streamlined process for both the financial institution and the customer.

Full details on Client Onboarding and Account Opening are viewable below.

Providing Client Advice

Providing advice to clients requires full access to all relevant information. LSPS therefore:

- Coordinates and tracks each stage of the process of giving advice to clients

- Identifies all relevant positions, transactions, and limits of the client

- Compares consolidated results with the client's risk profiles and requirements

- Generates client proposals

- Documents client meetings and decisions in a call report.

- Verifies any 'flags' and confirms that all necessary transactions have been executed

- Each step involved in providing advice is logged and auditable

Consolidated Reporting

Customers are generally able to contact their financial service provider by a variety of means: in person visit, phone, written or fax order. Each requires its own means of verification and documentation that includes the client's instructions. This, in turn, requires multiple actions, ranging from verification of request to ensure proper authorization, submitting request, regulatory/legal requirements, and verification that the process has been completed. This relatively straight forward process, however, may frequently involve an exception. LSPS follows each request through the required exception components, ensuring that each step is documented and accomplished in the most expedient manner.

Periodic Client Review

To facilitate the regular review of a client's accounts, LSPS provides the tools to

- Analyze a client's situation: Suitability (risk profile accuracy, bulk positions, asset allocation deviations, unusual transactions, and Lombard loans), KYC (US Person, PEPE, NTBR, SCAP, etc.), Active Portfolio Review, and Client profitability / Special conditions review

- Manage client meetings: Allows the financial advisor to easily document the relevant notes from client meetings and manage all ensuing components

- Comply with internal and external regulations with full Transparency and auditability

- Easily navigate records for quick, real-time information

Marketing Campaign Management

LSPS provides multiple means to facilitate marketing campaigns that includes an Adaptive Case Management (ACM) approach to focus campaign activities, such as dynamic campaign structures that can adapt to business goals, the ability to have 'smart selection' of candidate groups, online marketing analytics, and an option for call center integration. For more details please see below.

Whitestein's CLM is a comprehensive package; however, customers may choose which of the above processes they need to suit their own business model. Likewise, each process may be easily customized to specific customer needs.

Client Onboarding

The first impression of the account opening process sets the tone of the relationship between the financial institution and the customer, paving the way for future business opportunities. LSPS makes this process as seamless as possible both on the front end for the customer and on the back end, for the bank.

Many financial institutions retain components of paper-based onboarding processes, causing unnecessary complexity and delay. LSPS addresses these problems by coordinating the onboarding processes between the prospect and all associated banking staff. In so doing, LSPS proactively avoids bottlenecks, simplifies process navigation for involved employees, and reduces the significant losses incurred through wasted time and excessive paperwork. The direct result is a more efficient and satisfying experience for the customer. Specifically, LSPS allows financial institutions to:

- Expedite the application process

- Maintain up to date compliance standards

- Reduce inefficiencies

- Utilize data for future purposes

- LSP crosses business lines to autofill forms, reducing the number of forms customers are required to fill in

- Changes may be made to multiple forms across the process spectrum - i.e. if KYC rules are modified to request additional information, LSPS easily updates all relevant forms and processes, regardless of the product and bank division

- Changes can be made to all active process instances; informing the business user of the change required to an active account opening process

- Easy implementation, and clear, updated task lists minimize delays and confusion for the customer and employees.

- LSPS identifies bottlenecks and automatically resolves the problem within the preset parameters, with a notification to the business owner, or

- LSPS identifies bottlenecks and escalates to the business owner, with suggestions of best alternative paths to resolve the issue.

Data Capture

Data capture is often the start of delays and significant paperwork. Instead of requiring customers to fill out multiple paper forms, switching to digital forms saves the customer and the bank time and money.

Compliance

Information required for client approval varies based on many factors, ranging from type of product to risk components to income levels. As these factors change, LSPS provides the ability to safely make updates and ad-hoc changes to running process instances, resulting in fast and efficient implementation to all relevant parties and documents regardless of whether this occurs within a single division or across the entire bank entity. Ongoing monitoring of status triggers alerts for those instances requiring additional action, including those in mid process. The result is a more seamless flow for both the employee and the potential client.

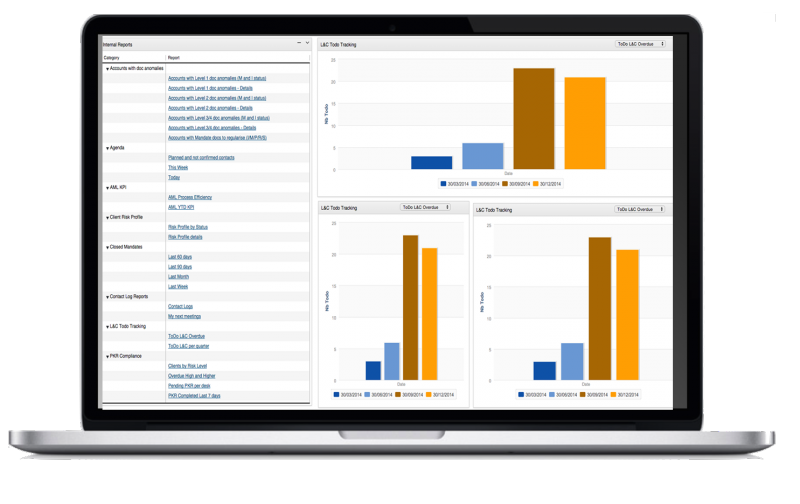

Analytics

Monitoring processes ranging from the time required to fill out forms to ensuring compliance with KYC and AML provides the business owner with an easy method to determine where bottlenecks occur and how best to eliminate the delays while still accomplishing the preset business goals. For example, through LSPS' intelligent goal-based solution, banks can determine how the system should respond:

Once a new customer application has been approved, the process does not stop. From issuing welcome kits to providing ongoing communication, analytics can help determine how best to further serve and market to customers.

Positive customer service results in the strongest marketing campaign in which any business can engage. Should the bank opt to codify customers' comments and questions to help both their experience and the bank's ability to further fine tune its processes to assist the customer, then LSPS allows business owners to include customer input into their process model.

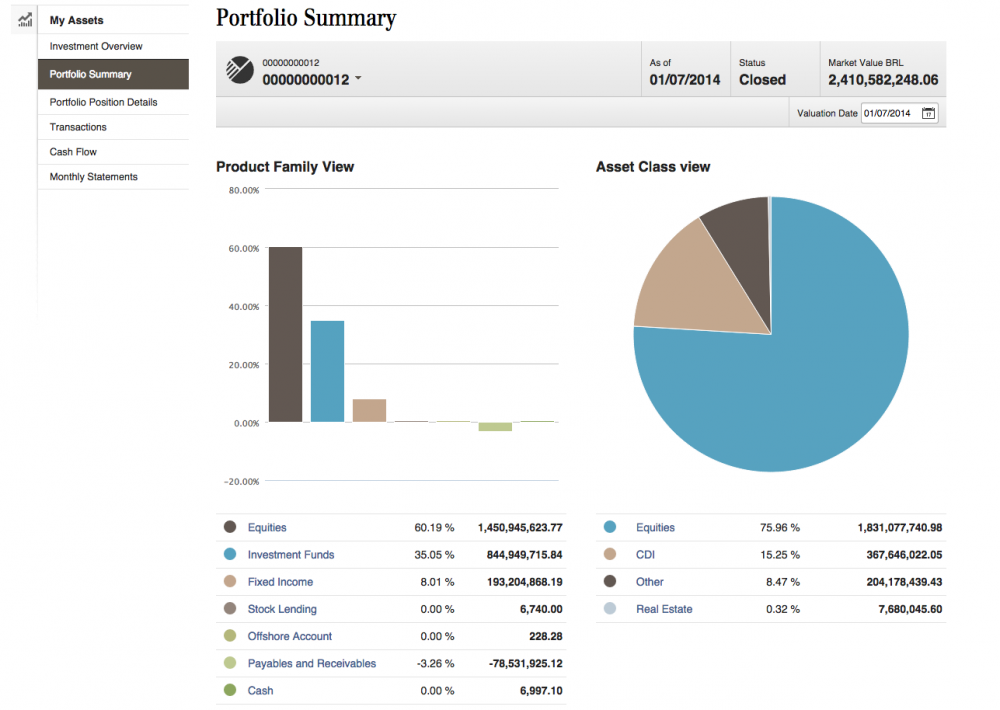

Portfolio Management

From initiating customer contact to managing portfolios, LSPS enables users to model a comprehensive set of intelligent, goal-oriented processes that form the core of a portfolio management system. Easily integrated with legacy systems, LSPS enhances existing solutions to meet customers' requirements in scope and scale, resulting in a flexible, integrated, and intuitive environment for both the bank and the customer.

LSPS portfolio management provides all functionality necessary to define both strategic and tactical asset allocations for discretionary management. Model portfolios may even be individually managed per segment to follow an expert oriented multi-manager approach. The automatically generated proposals can be adapted and used to create bulk orders.

The model portfolios can be assigned to client portfolios and applied in an automated rebalancing process to align the portfolios with the adapted strategies. The order proposals created can be individually amended by the portfolio managers and are checked against both legal and investment restrictions.

Key Features:

- Management of SAA and TAA

- Management of recommendation lists

- Segmented model portfolio definitions

- Multi manager capable design

- Order proposals

- Automated rebalancing against client portfolios

- Pre-trade checks against legal and individual restrictions

- Automated (bulk) order creation

Downloads

Regulation & Compliance

In today's environment, financial institutions must follow a myriad of evolving local and international regulations. Failure to fully implement these regulations can lead to a range of problems. LSPS crosses business lines with the necessary functionality to both accommodate the multitude of regulations, such as MiFID II, FATCA, OECD-AEI, FinfraG, FIDLEG, PRIIPs, AIFMD, HKMA, and Dodd-Frank, and provide the agility to quickly adapt and comply with the evolving regulatory environment. In so doing, LSPS also provides the ever important transparency and auditability required in the financial services industry.

LSPS streamlines the extraction and collection of relevant regulatory and compliance rules to be incorporated into new and existing processes. And because regulations must be implemented into a range of interactions, ranging from linear to complex, the intelligent core of LSPS is able to coordinate and analyze the full scope of the process interaction, autonomously inserting new components into workflows across the entire financial services landscape.

Features

- Client classification

- Risk profile questionnaires

- Appropriateness and suitability checks

- Portfolio health checks - pre- and post-trade

- Internal reporting

- Transparency and auditability

Downloads

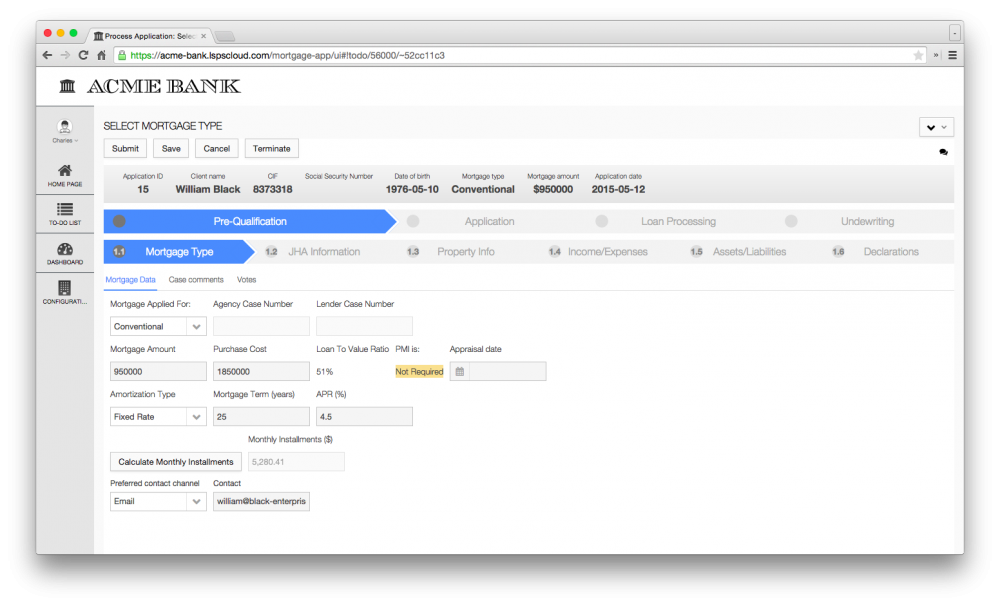

Mortgage & Loan

Mortgage and loan applications have evolved into complex, paper-intensive processes that require the involvement and interaction of multiple stakeholders and systems. Small delays, missing data, exception cases can each have much larger impacts on both the institution and the customer. LSPS seamlessly guides employees through each process, intelligently adapting to changing needs, proactively taking steps to avoid delays to meet preset business goals in a reliable, fast, and friendly way.

Mortgage and loan applications are sophisticated processes that demand the cooperation of multiple departments (Mortgage/Loan Dep., Underwriting Dep., Closing Dep., etc.) in order to be successfully completed. Using LSPS, all interactions are smoothly optimized, mediated, and monitored during every mortgage and loan stage ensuring the successful completion of required business outcomes. Full transparency ensures that business owners are able to see full status in real-time.

Pre-Qualification

This process allows Loan Officers to pre-qualify potential borrowers. Through the intuitive LSPS Dashboard, users can quickly process each task, while ensuring transparency for the team. This gives the team full knowledge of status, and thus the means to provide efficient customer service.

- Retrieve borrowers’ data, in cases where the borrower is an existing customers

- Connect to the integrated Client Onboarding Process and collect loan, personal and demographic information, current income, employment, and debt information from the Borrowers and Co-Borrowers, if available

- Provides initial risk profile analysis, based on rules defined at design phase or at run-time by financial institutions

Application Process

Today’s world necessitates the rapid expansion of digitalized document exchange. If a loan has been successfully pre-qualified, LSPS allows for the synchronous (message exchange, integrated discussion board) and asynchronous (emails, sms, etc.) interaction and document exchange between the financial institution and the customer. LSPS makes it easy to integrate all the provided communication channels into the workflow of the business process.

Loan Processing

Loan processing is the most important and more sensitive stage of a mortgage/loan application. LSPS enables financial institutions to:

- Automatically connect to third-party systems (core banking, insurance companies, government services, debt repositories)

- Retrieve customer information and easily embed that information into the loan process and the decision-making policy

- Update data provided by the customer at previous stage, and use the data to modify the workflow path without delaying the whole loan process

- Generate any digital documentation at any point during the process

Underwriting & Closing

The last two stages of a mortgage/loan process include the interaction of the financial institutions’ employees for the approval decision. LSPS provides support for collective decisions by introducing voting protocols for any department, role or employee of a financial institution. In addition, this stage of the mortgage/loan application significantly benefits by the LSPS data export mechanisms. After reviewing and evaluating the application and associated documents, a set of documents and reports must be produced, regardless of the ultimate decision. LSPS automates this procedure and exports the necessary information in multiple electronic formats (doc, xls, PDF, XML, etc.).

Downloads

Digital Banking

Simple and intuitive Web and Mobile applications providing banking clients with direct online access to their accounts, portfolios and performance reports.

LSPS Digital Banking solutions are designed to provide banking clients with complete access to their financial data in a clean and intuitive dashboard approach. The solution is designed to be customizable to the needs of each financial services business, while preserving key features including minimal clicks and clean presentation of information.

Features

- Home dashboard with an overview of all account holdings

- Drill-down detail charts and tables showing assets by type, currency, sector, and many other attributes

- Order capture with integrated processes manage asset purchasing and sale to ensure regulatory, suitability, and account restriction rules are observed

- Account subscriptions

- Management of non-account holders, including Powers of Attorney

- Provided and user-definable reports in PDF and Excel format

- Access to published resources, such as research and market information

- Secure messaging for communication between client and advisors

Downloads

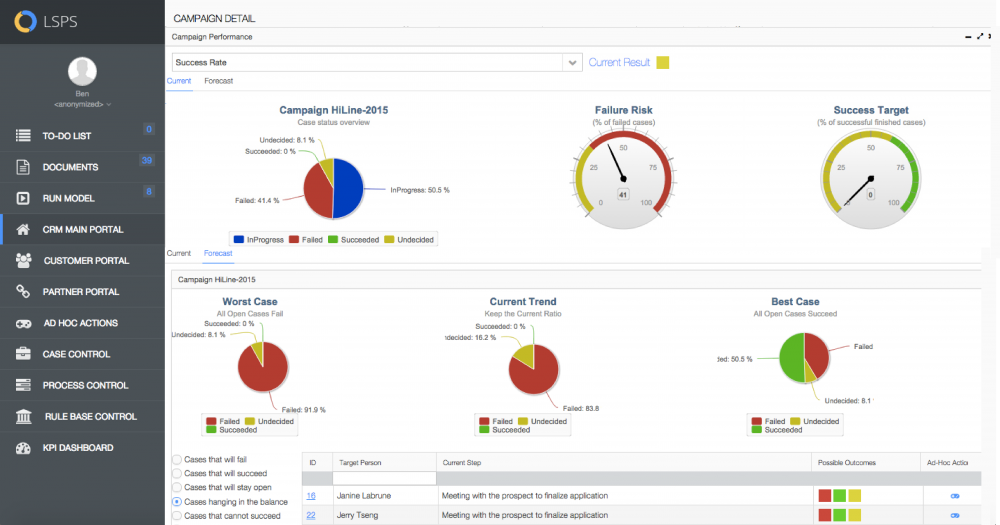

Campaign Management

LSPS Campaign Management enables precise targeting of customers, to ensure the right people receive the right materials at the right time, while making sure that nobody is inundated with mailings irrelevant to their own circumstances.

LSPS Campaign Management is a comprehensive tool that can be generally defined by three primary stages: Definition, Execution, and Assessment.

Definition

Through this stage, users are able to create and manage campaigns. The target audience is easily determined by defining any number of search criteria to precisely tailor the list of recipients.

Of course, Campaign Management is not simply identifying the audience. LSPS allows users to establish the basic attributes - Project description, Goals, Workflows, Timeframe, Budget, as well as Expected and Real Costs - that are necessary to successfully implement a campaign. And because there are often many people involved in various stages of a campaign, LSPS' change management tools are designed to facilitate communication, transparency, and consistency.

Execution

Execution is the stage in which the workflows are processed. The intuitive, web-based dashboard makes it is easy to quickly view status, see potential and actual delays, modify individual cases, skip non-mandatory steps, or include pending items, if one-off situations occur.

Assessment

Not only does the Assessment stage provide for reporting and performance evaluation of completed campaigns, it also provides a real-time, adjustable view on executing campaigns. This includes a range of KPIs, such as Contact Rate and Success Factor, so that progress can be evaluated at any stage.

Combined, these three general components provide a powerful and agile tool to manage campaigns, with the ability to easily assess success on multiple levels.

Features include:

- Basic Attributes

Name, Description, Goals, Start/End dates, Status, Budget, Expected Cost, Expected Revenue, Real Cost, Real Revenue - Target Group

Provides a variety of search criteria that allows for general and highly tailored campaigns - Steps

Templets for concert actions within the scope of a campaign, which is organized into workflows that define the order and conditions of campaign actions. - Communications Channel

Provides the capability for users and targets to communicate - Time Window

Convenient view of activity, including start date, end date, and status - KPIs

Relevant KPIs for business needs, such as Contact Rate, Success Factor, Costs - Dashboard View

Web-based, user friendly Dashboard from which users may easily view all components of the Campaign at any time

Downloads

Dispute Resolution

Credit and debit card disputes are traditionally a no-win situation that often results in disgruntled customers and inefficiencies that, for financial institutions, result in loss of time, money, and potentially customers. LSPS rectifies these problems by providing a comprehensive set of Web-based tools that encompass the entire timeline. From initiation to resolution, banks are able to provide their customers with answers and resolutions in a manner that makes the process as painless as possible for all parties involved.

The results include more satisfied customers who, often with a single contact, are able to have their questions answered without the hassle of call transfers, call backs, and delays. Furthermore, because employees can easily see next steps, training time is reduced, and processing errors are minimized.

The ability to easily incorporate compliance requirements from the beginning of the claim further streamlines the process, while making it auditable. Changes to the process may be quickly implemented in real-time and may be seamlessly integrated into an ongoing process, ensuring that claim processing time is impacted as minimally as possible.

Features

- Intuitive, web-based dashboard from which all functionality is accessible

- Easily identify and process the type of claim, regardless of whether received by mail, email, website, phone

- View the road map of next steps for each type of claim

- View claim status

- Assign disputes to customer service representatives with expertise in specific types of disputes

- Proactively identify and avoid potential bottlenecks

- Check database for potential abusers of dispute resolution processes

- Satisfy compliance regulations, including Fair Credit Billing Act and Regulation Z.