Whitestein Technologies is proud to be a Platinum Sponsor to the annual...

You are here

Whitestein Mobility Means Faster Claims Processing for Insurance Company

When we added mobility features to our insurance-industry solution for Living Sysytems Insurance Claim Adjustment (LS/ICA), we asked a group of customers to provide us with some feedback on how the new mobile-centric approach was affecting their daily business.

The Vienna Insurance Group in Europe has been using the LS/ICA for several years, reported that the new mobile features were leading to huge improvements in the accuracy of claims and speed of processing.

Speeds upload of information

Typically, each damage adjustment incorporates complex data entry, upload of scanned documents, and as many as 20 photographs per adjustment. Now the company’s adjustors in the field use their mobile devices to input the details of each automotive or property claim directly into the native tablet/smartphone app. They no longer need separate cameras; they use their registered and centrally managed devices to take photos and upload them as part of the claim case. The proprietary app is tuned to support efficient uploading of large numbers of pictures. With three versions available, LS/ICA runs as a native app on iOS, Android, and Windows Mobile platforms.

Improves accuracy of claims

Because adjusters immediately photograph damage and upload it to the system with their mobile devices, there are fewer opportunities for people to make fraudulent claims.

Shortens adjustment process

By “mobilizing” the insurance company’s adjusters in the field, LS/ICA has shortened the adjustment process and eliminated the paper-based claims processes that many insurance companies still use. Back in the office, claims adjusters can add more information, such as police reports. LS/ICA then compiles all the information on the claim to help create damage calculations. The system provides the adjusters a full description of cost, fault, repair time, and other details so they can make the appropriate insurance decisions and provide better, faster customer service. Adjusters dispatch requests to third-party providers for instant quotes on the cost to repair damage.

On the back end, LS/ICA provides standard integration using secured REST services. The system is also integrated with Microsoft Exchange, so even if there’s a short-term network outage, adjusters can still view all appointments using their mobile or desktop devices.

Facilitates partnership with repair companies

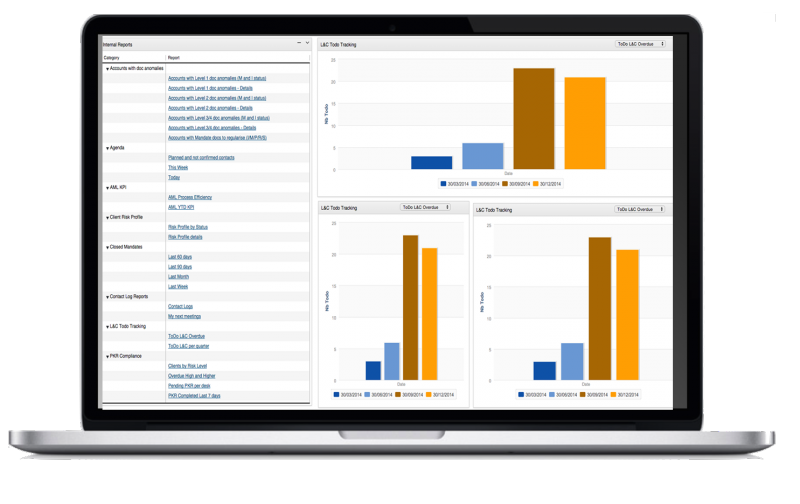

A thin web client for LS/ICA makes it easy and inexpensive for car repair shops and glass damage assessment companies to partner with the insurance company, provide quotes, and schedule repairs. LS/ICA also supports monitoring of the business processes and of the workforce itself. It acts as a control center for handling special cases and providing an overview of the business.

Roadworthy features inspire company to extend mobility across its daughter companies

With the comprehensive mobile and desktop functionality of LS/ICA, the Vienna Insurance Group can now process claims more quickly and more cost-effectively. The company is so satisfied with the flexibility, productivity gains, and increased profitability it has achieved through LS/ICA, that it has already expanded its use of LS/ICA to additional daughter companies.